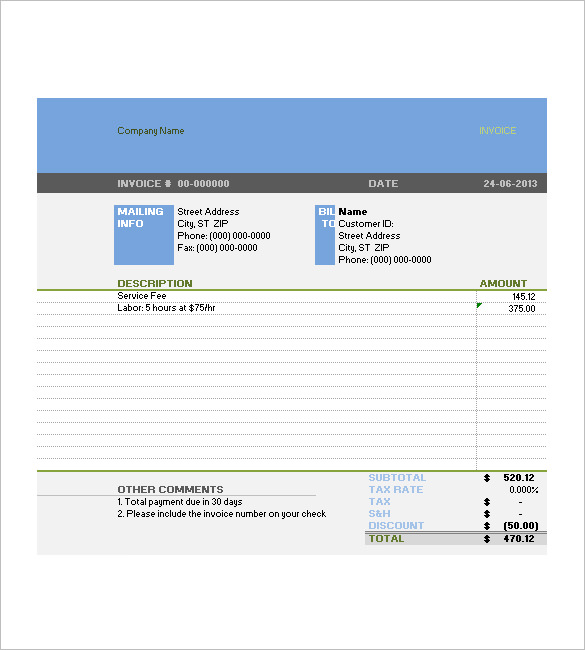

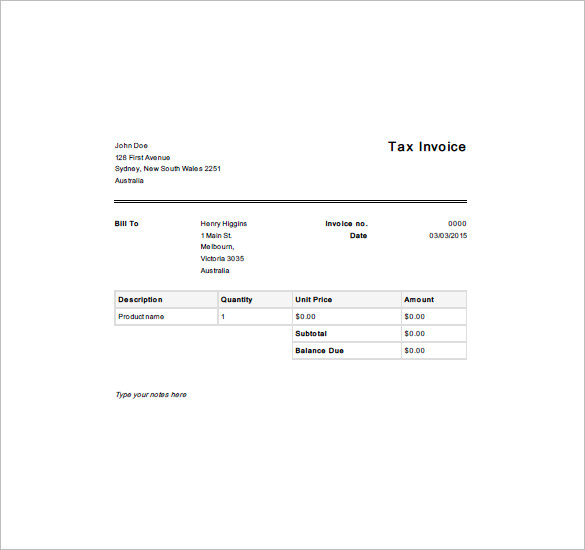

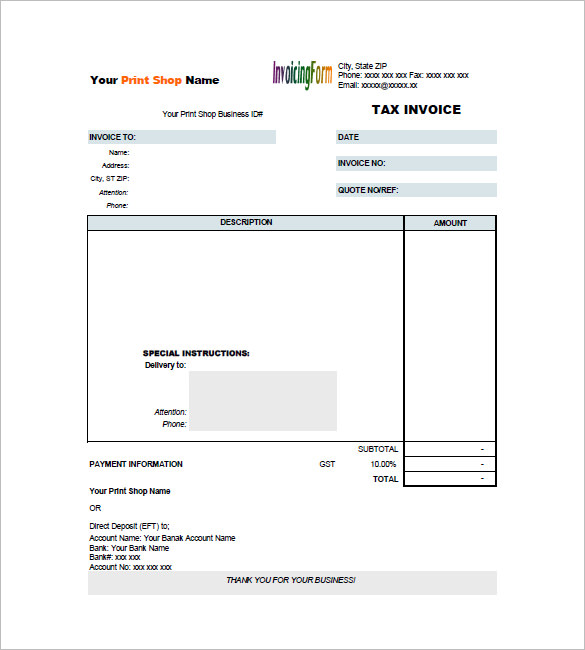

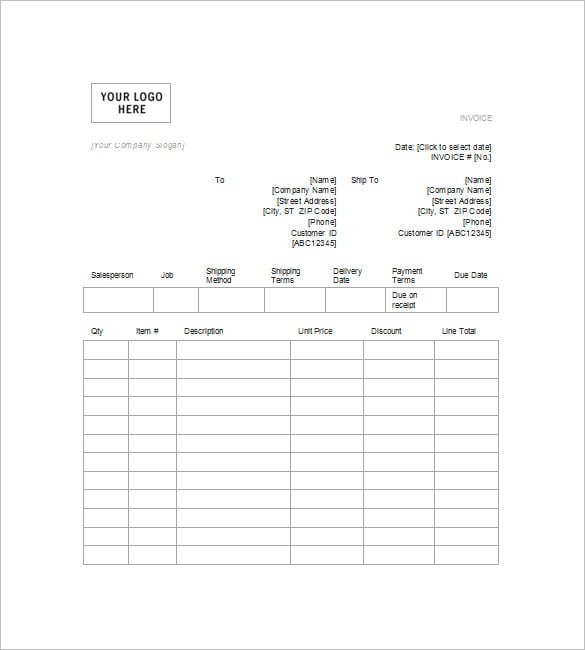

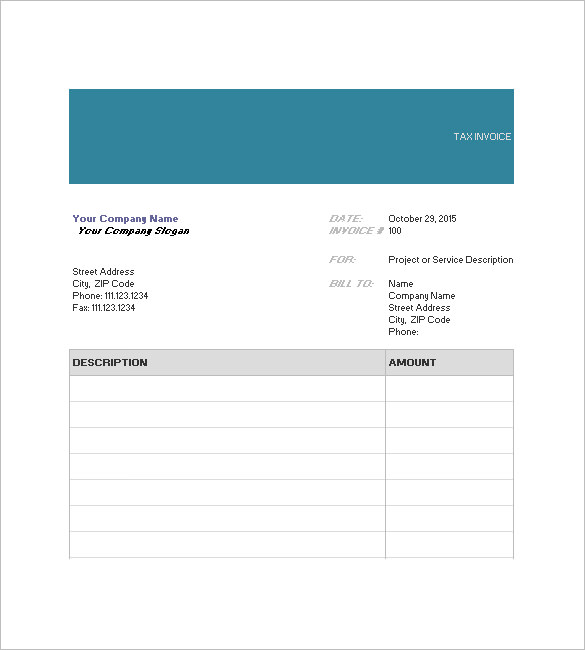

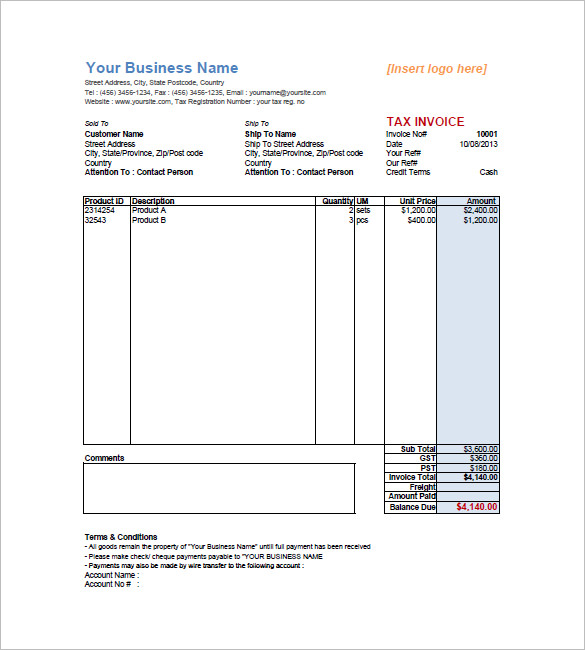

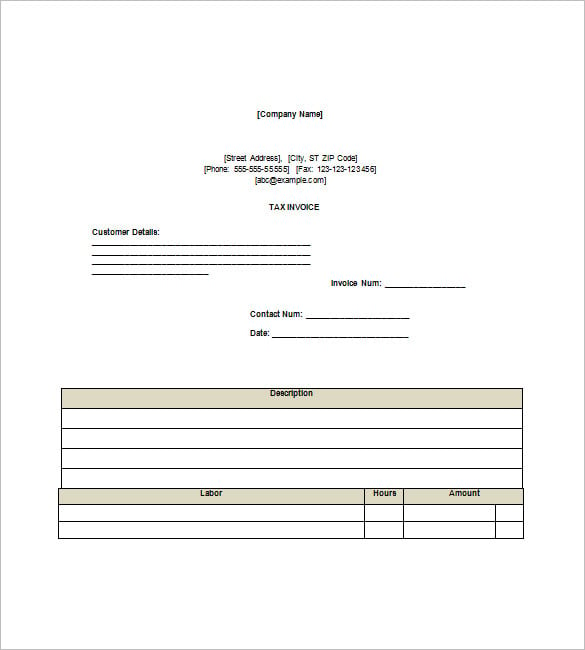

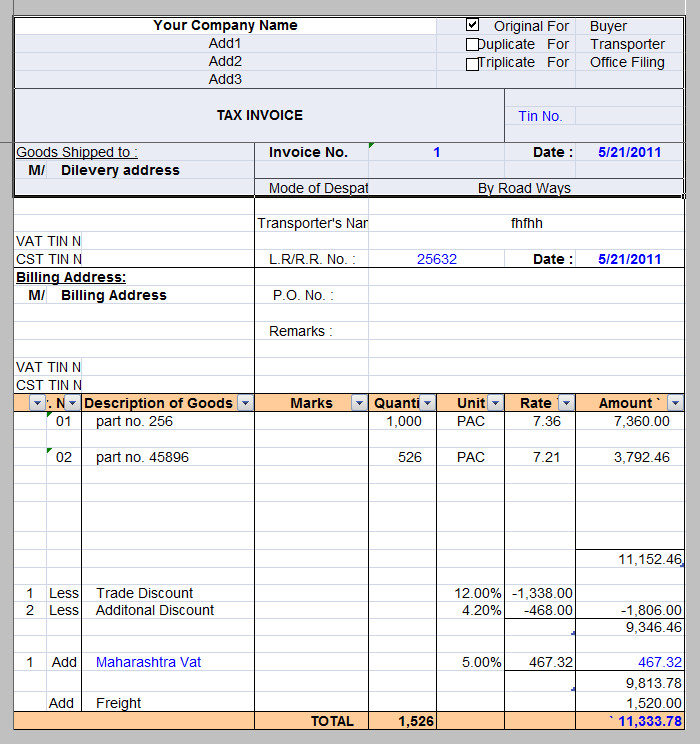

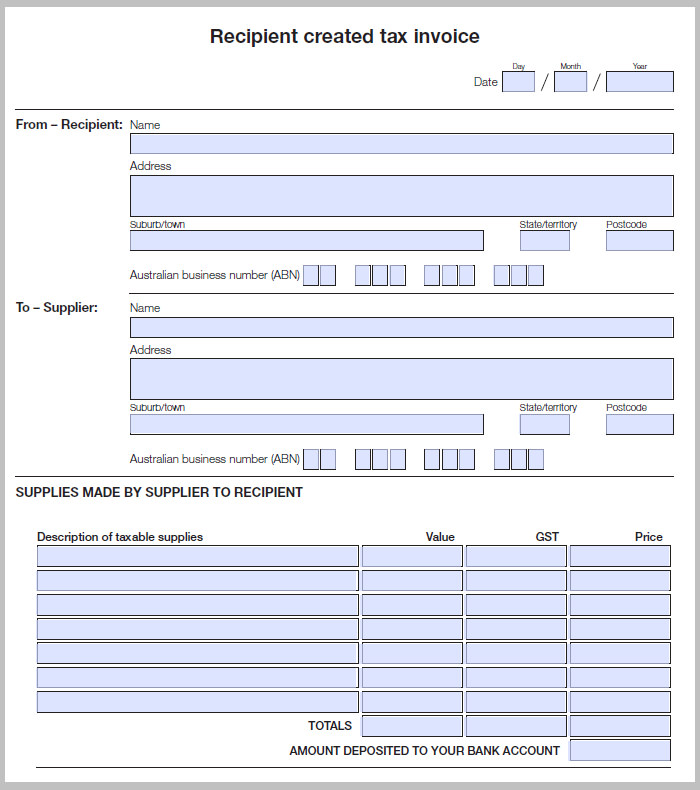

A tax invoice template is a standard format invoice required underneath the Goods and Services Tax system. A goods and services Tax registered organization must have a legitimate Tax invoice from the provider in an effort to claim lower back the Goods and Services Tax they have got paid on the purchase for their commercial enterprises. It is a primary proof to guide an input tax credit claim. A receipt or proof of purchase is a document which is provided to the customers in a business, company or organization as a record of their purchase of goods or services. A tax invoice template can be in the form of a receipt, or a printed cash register or handwritten invoice. It is a most crucial document which must be issued by a company and organization in order to require by law to collect value added tax for the taxable products or services. This document is an evidence for the buyer which identify value added tax has been paid.

Details of Tax Invoice

There is a tax invoice number on the receipt of purchased products or services and record of investment or payable amount. It is a mention on the top right-hand side of the tax invoice and will be in the form of digit, usually three digits. It is a legal document which is issued by a dealer or agent to their purchasers for describing about the payable tax amount. In order to generate a well presented tax invoice, you should be used an elegant tax invoice template to fulfill your desired need. Our offer template is a creation of experts and trained persons and can be use multiple times to concede to your need. You can use this template without make any single adjustment and for various professional purposes. We always bring a beneficial template according to your requirement. You can easily download this marvelous tax invoice template from our exclusive website.